Precious Metals Investing Plus Dividends?

Gold and silver are major investment areas that are in the news these days. With massive runs in the last ten years, some investors are considering abandoning stocks completely in favor of “hard assets” such as gold and silver.

While I’m a major proponent of precious metals for a part of your portfolio, and I in fact,have owned gold and silver positions for many years, these positions do not negate the need for dividend stocks.

Now, I do have macro-economic views that prevent me from getting majorly bullish on the broad stock market. I think there are massive challenges that were never fixed in the recent financial crisis and we’ve done nothing but sow the seeds for the next crisis. This is a major reason why we push patience in finding great buying opportunities of great companies.

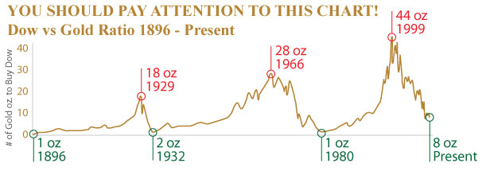

The relationship of gold/silver and the stock market is interesting. The following chart is one of the most interesting (and possibly important) charts that you need to understand in the current market:

The above chart shows the relationship between the price of gold and the Dow Jones Industrial Average. As you can see the chart has gone from extreme high to extreme low with regards to the ratio over multi-decade time horizons. If history repeats itself, we should be approaching a Dow vs Gold ratio of 1:1 in the coming years.

This is insanely important and I have two conclusions assuming history repeats itself:

- If the Dow:Gold ratio hits (or goes near) 1:1, it will definitely be a prudent time to sell your gold positions and buy stocks.

- Hoarding cash and waiting for this moment will not necessarily work, because inflation could push stocks way higher and gold even higher resulting still in a 1:1 ratio (think 20,000 Dow level / $20,000 gold price). In this case, your cash would basically be getting killed against everything, and waiting for this ratio did you nothing.

What should you do with this information?

First, as an investor, you should monitor this trend. Second, you might consider acting on it to a certain degree depending on your situation. If you already own gold positions, perfect. Sit tight and watch this trend. If you don’t, well, you’ve missed most of the boat, but you might consider scaling into some positions.

Do we not buy any stocks until this ratio approaches 1:1? No. But, it might mean not buying the broad stock market until the ratio is closer to 1:1. Until then, I will hold on to my precious metals positions and continue to research and accumulate quality companies at quality buy levels. This is our mission. We will watch this trend unfold and continue to update our readers.